Risk Management

Within the risk management departments you face several challenges, like:

- Inadequate information for effective KYC processes

- Time-consuming manual checks for risk profile changes

- Labor-intensive contract issue identification prone to errors

With its advanced algorithms and extensive data, Mandy addresses these challenges.

- Mandy enhances the KYC process by providing detailed client/item information.

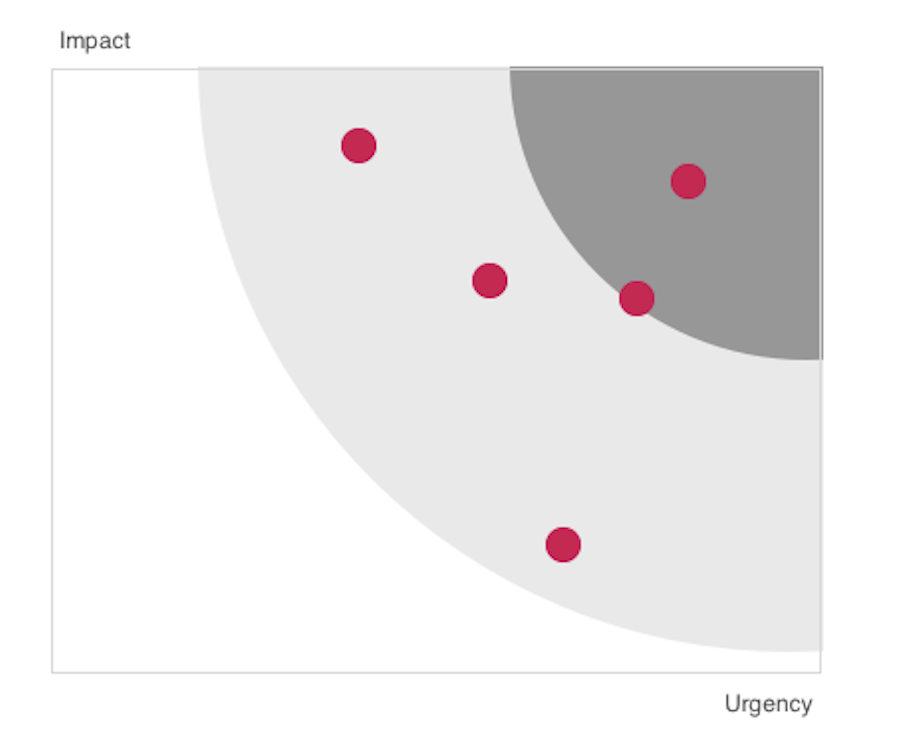

- Mandy automates risk profile checks, ensuring continuous monitoring and timely alerts.

- Mandy finds issue in contracts and other sources, enhancing accuracy.

Prospect, Client and Vendor Monitoring

With Mandy, effortlessly monitor client activities and market dynamics, gaining the foresight to anticipate potential bankruptcies before they unfold.

Market and Supply Chain disruptions

Mandy detects market and supply chain disruptions using advanced algorithms. It analyzes diverse data sources and monitors events in real-time, including supplier performance, to enable proactive risk assessment and response, ensuring operational continuity.

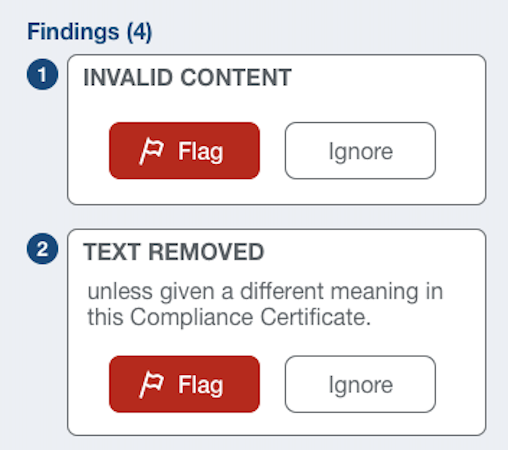

Contract Tracking and Red Flag detection

Let Mandy identify red flags across contracts and other sources, like pinpointing differences in information or discrepanies between versions, enhancing the reliability of risk assessments.

Request a demo

Please fill in your details on the right. We will contact you as soon as possible to schedule a demo or to have a deeper discussion on how Mandy could help you futher.

Looking forward to talk to you!

emailInfo@kentivo.com

tel.+31 (0)30 2077077

The rise of A.I. in Risk Management: A Game-Changer for Modern Businesses

Discover how AI is changing the way we manage risks, addressing challenges from inadequate information (KYC) to contractual issues.

Identify the threat!

Know your Customer (KYC) and receive detailed information on specific clients

Get notified by changes in regulation

Be aware of the negative news, like fraud, scams and security threats

Understand what is happing at vendors, for example know about bankruptcies